Renters Insurance in and around Opelika

Welcome, home & apartment renters of Opelika!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

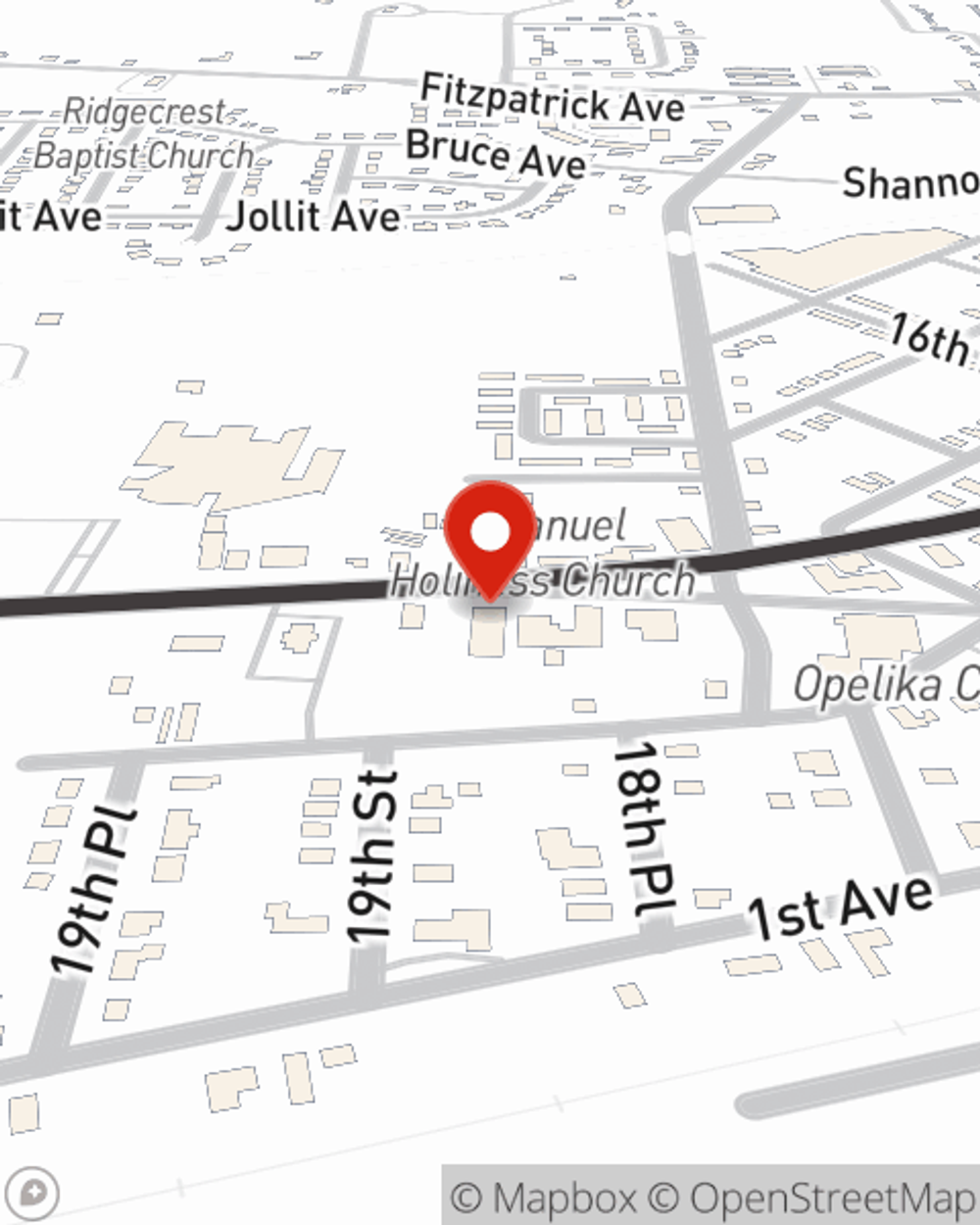

- Opelika, AL

- Auburn, AL

- Lake Martin

- Phenix City, AL

There’s No Place Like Home

Think about all the stuff you own, from your bed to couch to towels to coffee maker. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of Opelika!

Renters insurance can help protect your belongings

There's No Place Like Home

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Matt Coffey can help you develop a policy for when the unpredictable, like a water leak or an accident, affects your personal belongings.

There's no better time than the present! Get in touch with Matt Coffey's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call Matt at (334) 749-5777 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Matt Coffey

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.